How to Value Goodwill When Selling a Business

When a business is sold for more than the fair market value of its tangible assets, the difference in the selling price and the value of the assets being acquired is recorded on the buyer’s balance sheet as goodwill. The value of goodwill, which is determined by a calculation, is the amount attributed to intangible assets the buyer is acquiring. Intangible assets usually included when selling a business include: business reputation, brand recognition, customer and supplier lists, employee knowledge, internal processes, etc. There may be other intangibles as well such as copyrights, trademarks, patents, trade secrets, customized software and/or databases, etc.

How to Calculate Goodwill When Selling a Business

The best way to understand how to value goodwill when selling a business is to provide an example.

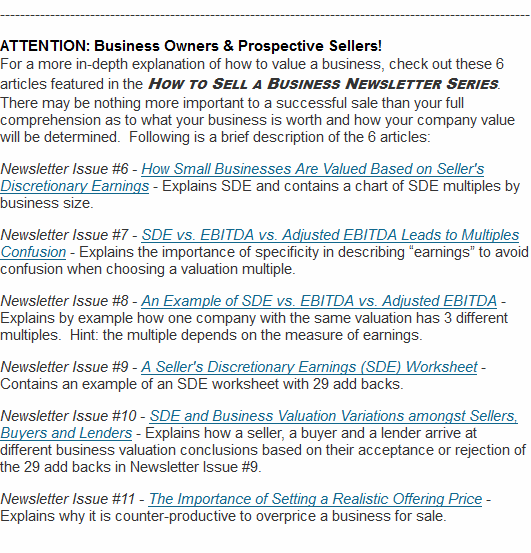

Let’s assume a seller has a machine shop with $2,500,000 in revenues and $500,000 of seller’s discretionary earnings (SDE). In a business sale structured as an asset sale, according to the chart in Newsletter Issue #6 - How Small Businesses Are Valued Based on Seller's Discretionary Earnings (SDE), a multiple of 4x would yield a business valuation of $2,000,000 for the machine shop. (This example assumes the seller is retaining all accounts receivable and cash as of closing and is responsible for paying off all liabilities at closing.) Now let’s assume the machine shop has equipment with a fair market value of $1,200,000 and inventory of $150,000. The value of goodwill is the purchase price of the business ($2,000,000) less the value of the tangible assets ($1,350,000) which calculates to $650,000 as the value assigned to goodwill.

Negotiating the Value of Goodwill for Its Tax Implications

In a business sale, for tax purposes, the buyer and seller must agree on an allocation of the purchase price to the various assets being acquired, including the value of goodwill. However, their interests are at odds with one another.

The buyer wants to maximize the allocation to tangible assets which are generally depreciated over periods of 5-7 years, whereas the value of goodwill is amortized over 15 years. On the other hand, the seller generally desires to minimize the allocation of the purchase price to tangible assets, which can help reduce the onerous depreciation recapture tax provision. In addition, for the seller, the value of goodwill is generally classified as a capital gain with lower tax rates than ordinary income rates.

The Value of Goodwill as “Blue Sky”

If you’ve heard the term “blue sky” in conjunction with a business acquisition, it usually refers to the value of goodwill. It’s a term that carries a somewhat negative connotation indicating that the value of the business is not supported by significant tangible assets. Instead, a lot of the value is in goodwill (“blue sky”).

Despite the lack of tangible assets, it is fair to value businesses based on cash flow (EBITDA or SDE). So, the negative connotation attributed to “blue sky” is unjustly biased. However, it occasionally is a factor in the pursuit of financing. For example, the criteria for SBA loan approvals changes and becomes more restrictive when the value of goodwill exceeds $500,000.

For a more complete picture of how to value a business for sale check out the article: how to value a small business for sale